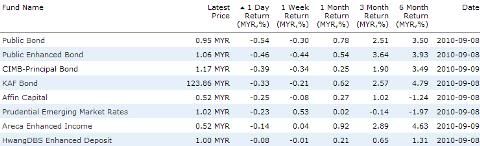

近两天市面上的部分债券基金遇上了小震荡,一日跌幅高达0.1至0.5%之间,非常不寻常。其中以大众信托与联昌信安旗下的债券基金最受伤,名列当天跌幅最大的前三名(请参考下图)。不过幸好这两家资产管理公司的实力不差,这几支基金的近一年或更长的回酬依然可观。

债券基金“暴跌”的情况不常见,通常是受到所投资的债券遭到降级或违约。这次就是雪州水务相关公司的债券被大马评估机构(RAM Ratings)降级所造成的。包括雪州水务控股(Syarikat Pengeluar Air Sungai Selangor Sdn Bhd,简称SPLASH)在内相关的水务公司的债券投资评级,从AA2调降至BBB3。同时,该评估机构也继续将这些水务公司的债券列入评估观察名单中,保持负面展望。其他两家公司是Destinasi teguh Sdn Bhd,以及Sungai Harmoni Sdn Bhd。

SPLASH是雪州水供公司(Syabas)的净水供应商之一,该公司所生产的净水都是卖给后者。该公司发售的马币14亿700万元的回教债券(Al-Bai Bithamin Ajil,2000年至2016年)遭大马评估机构从AA2评级调降至BBB3评级。Sungai Harmoni是SPLASH的营运与保养服务供应商,主要收入来自SPLASH,而Destinasi teguh则依赖Sungai Harmoni的利息与股息来支付债券。这两家公司分别发售9000万元的可赎回债券股和3亿9500万元的有担保债券。这两批债券的评级也同样从AA2被调降至BBB3。

检验了CIMB-Principal Bond Fund 7月份的基金简报,净资产2.8亿的其中2.01%投资在SPLASH,所以连续出现两天的下跌也挺正常。

债券基金的回酬表现(8日&9日)

新闻来源

评估机构下调水务债券评级

Syabas拖累雪三家水务公司

1 comment:

后记

At the time of downgrade, CIMB-Principal Bond Fund (the Fund) has a total exposure of 2.19% in Puncak Niaga bonds and 2.05% in SPLASH. The Net Asset Value (NAV) for the Fund on 7 Sept 2010 prior to the downgrades was 1.1785. Since the bonds’ valuation are marked to market daily, ie, valued based on their fair prevailing market values, the impact of these downgrades saw a drop of 0.50% in the NAV of the Fund to 1.1726 on Sept 9th after the valuation for Puncak Niaga and SPLASH were adjusted according to their new ratings.

We take comfort that as senior bondholders, the Fund’s exposure is well covered by a fixed and floating charge of all assets of Puncak Niaga. The Fund also has a legal assignment over SPLASH’s project documents and a debenture on all of SPLASH’s assets. These securities can in turn be sold to the Malaysian Government at full book value. This implies that even in the worst-case scenario, the Fund should see a full recovery on the investment.

We remain positive on the Malaysian bond market despite this situation as macro fundamentals continue to point to a recovery in general, while healthy liquidity in the system is likely to continue to lend support.

Post a Comment