降息消息宣布后,全球市场反映热烈。美国股市方面,道琼斯平均工业指数上涨2.51%、Nasdaq指数上涨2.71%,德国法兰克福指数上涨1.27%,英国伦敦金融时报100指数上涨了1.63%。亚洲股市今早同样出现高幅度的上扬,香港恒生指数甚至出现了历史的新高25,648.44点。马来西亚股市就逊色多了,收市时才涨了1.55%,挂1297.16点。

指数 | 闭市 | 起落 |

隆股综合指数 | 1,297.16 | +19.83(1.55%) |

香港恒生指数 | 25,554.64 | +977.79(3.98%) |

台湾加权指数 | 8,926.38 | +26.47(0.30%) |

新加坡海峡时报指数 | 3,594.36 | +116.61(3.35%) |

日经225指数 | 16,381.54 | +579.74(3.67%) |

汉城综合指数 | 1,902.65 | +64.04(3.48%) |

孟买证交所敏感指数 | 16,322.75 | +653.63(4.17%) |

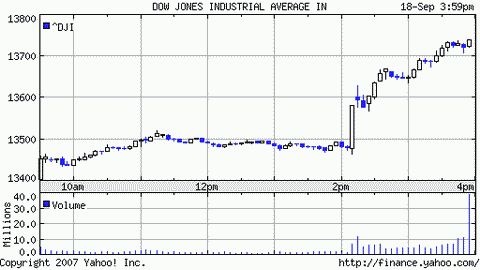

道琼斯平均工业指数在降息消息公布后出现直线上升

Fed cuts rates by a half point

The Federal Reserve lowers the target on a key short-term interest rate for the first time in four years from 5.25% to 4.75%

September 18 2007: 2:18 PM EDT

NEW YORK (CNNMoney.com) -- The Federal Reserve cut the target on a key short-term interest rate by a half of a percentage point Tuesday to 4.75%, further acknowledgment from the central bank that the mortgage meltdown plaguing Wall Street and Main Street could have a negative impact on the economy.

The cut to the federal funds rate, the first since June 2003, was widely anticipated by investors and followed a surprise cut to the Fed's discount rate on August 17. The only question was whether the Fed would lower the federal funds rate by 25 basis points or 50 basis points. (There are 100 basis points in a full percentage point.)

Blocked AdThe federal funds rate, an overnight lending rate that banks charge each other, is important since it influences the amount of interest consumers must pay for various types of debt, such as credit cards, home equity lines of credit and auto loans. The rate cut should help some beleaguered home borrowers who are set to see monthly payments on adjustable rate mortgages rise later this year.

CNNMoney.com

No comments:

Post a Comment